Modernization of Signal Technology on the Island

Jan 7, 2026 at 11:31 AM

Jayud opens new warehouses in California

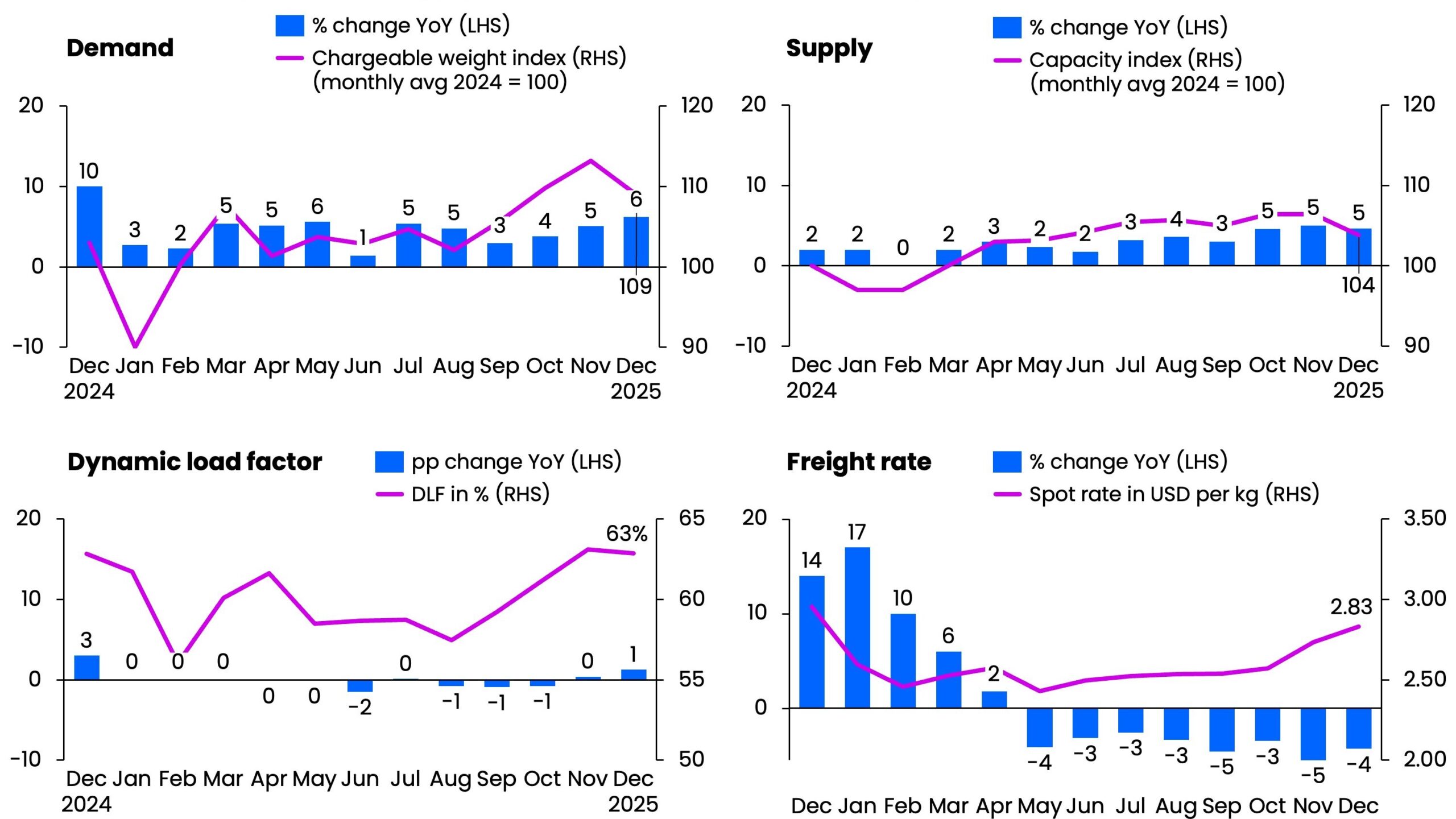

Jan 7, 2026 at 12:53 PMThe air freight industry concluded 2025 with a volume increase of 6% in December, indicating a positive trend. However, concerns remain regarding stagnating e-commerce shipments from China, which could cloud the industry’s outlook. This is reported by analysts from Xeneta.

In the fourth quarter of the previous year, air freight volumes performed better than expected, leading to a 4% increase in gross weight compared to the previous year. This development reflects the willingness of many shippers to switch to the speed and reliability of air freight during times of disruption and economic uncertainty. Niall van de Wouw, Chief Airfreight Officer at Xeneta, stated that 2025 „had something to offer for everyone,“ as service providers benefited from higher volumes and shippers enjoyed lower prices in the second half of the year.

However, for 2026, Xeneta expects a more cautious forecast with a moderate volume increase of 2 to 3%. Van de Wouw expressed that there may be „a price to pay,“ as uncertainties in trade and geopolitical tensions could weigh on air freight volumes. Despite the growth in demand last year, global air freight prices have remained below the levels of 2024 in recent months. In December, global air freight prices fell by 4% compared to the previous year, averaging $2.83 per kg.

Challenges in E-Commerce

The future development of air freight will be heavily influenced by e-commerce demand. Van de Wouw pointed out that investments in artificial intelligence had a positive impact on demand in 2025, but the less optimistic signals for e-commerce, particularly regarding cross-border exports from China, are concerning. According to Chinese customs authorities, exports in November increased by only 1% compared to the previous year, following stagnation in October. The decline in exports to the U.S. was particularly pronounced, dropping by 52% year-on-year in November.

While e-commerce volumes between China and the EU continued to grow, the pace slowed, with a 29% increase in November compared to 47% in October. Additionally, the Chinese State Council has introduced new tax reporting rules for online platforms, set to take effect in October 2025. These regulations could increase export costs and impair competitiveness in international e-commerce.

Regulations and Market Changes

The international cross-border e-commerce sector will operate in an increasingly regulated environment. The U.S. and the EU are introducing new regulations that are expected to take effect from the 2026 fiscal year. For instance, the EU decided in December to implement a fixed customs fee of €3 on small packages under €150 starting July 1, 2026. These measures could slow growth in e-commerce, although it may still outpace the general air freight market.

Van de Wouw emphasized that air freight e-commerce volumes could also be affected by declining consumer purchasing power, as consumers face higher prices for everyday goods.

Spot rates for air freight continued to decline in December, with the most significant drop occurring on the transatlantic route from Europe to North America, which saw a 13% decrease. Despite a 2% decline in demand compared to the previous year, spot rates increased by 17% month-on-month, indicating heightened demand.

Changes in Contract Behavior

Contract behavior has also changed. Nearly half of the volumes from shippers were purchased on the spot market for up to one month, a remnant of the pandemic. In the fourth quarter of 2025, one-year contracts accounted for only 24% of new agreements, representing a decline of 20 percentage points compared to the previous quarter.

Market conditions suggest a potential downward trend. Van de Wouw stated that the biggest risks for air freight this year include a possible decline in growth. The stability of the market could be jeopardized by decreasing demand in the first half of 2026.