Mercedes-Benz Trucks Aims for World Record in Reverse Driving

Apr 29, 2025 at 7:28 PM

EIPL Launches Single-Use Logger EIPlog and New Qualification Package

Apr 29, 2025 at 7:49 PMAlthough Germany has experienced an economic downturn in the last two years – a situation that usually leads to lower transport prices – the reality is different. Many market participants are surprised by the high prices for short-term spot transports within Germany.

Von: Christian Dolderer

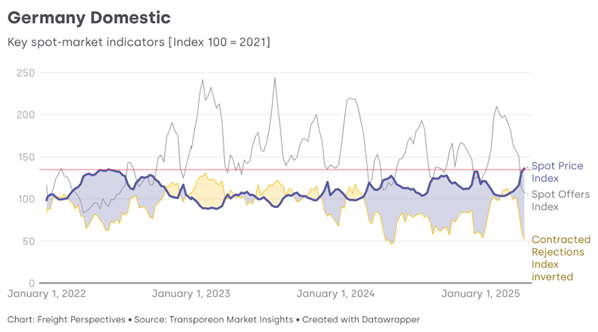

In KW17, spot prices in Germany surpassed the peak of 2022 (red line) and reached a new all-time high. This development is particularly interesting considering that the confidence of companies and economic activity in this region of Europe are significantly dampened. How does this paradox arise, and what factors play a role?

Strong demand can be ruled out, but how can subdued demand lead to such high prices? The main reason for this is the lower available capacity, especially in the Western European markets, which has been clearly reflected in the rejection of orders since 2024 (yellow line). The reasons for these capacity bottlenecks are multifaceted, with the currently low contractual price level significantly contributing to the high rejection rates. The procurement departments of shippers, under pressure to reduce their costs in the current difficult economic environment, often resort to riskier allocations to lower overall transport costs. This risky strategy leads to an increase in rejections, which during peak times forces a rapid utilization of the spot market and the associated price discounts.

Freight Forwarders Struggle with Business Losses

Conversely, freight forwarders are struggling with business losses, which can often lead to fleet reductions and partial layoffs of drivers. The spot market is currently, especially during cyclical peak times, the only segment where cost coverage or profit margins can be achieved. As a result, freight forwarders are reliant on overweighting the spot market in their business mix by rejecting contracted transports beyond the agreed minimum – a less preferred and sustainable business model for both sides. The consequence is the executed higher rejections and a self-reinforcing cycle that is only possible during times of general capacity shortages and short-term demand spikes.

The market is essentially in a delicate balance. Should demand increase, capacity bottlenecks will occur. Additionally, the last few years with their ongoing uncertainties do not provide a good investment climate for freight forwarders, so a larger fleet expansion is not to be expected. Drivers are also not easy to find in times of driver and skilled labor shortages.

Germany is a Prime Example

Germany is a prime example of this paradox and will likely be most affected along with France. The spot price level in Germany has probably not yet reached its peak during the upcoming holidays and could rise by up to 5 more index points in the coming weeks.

Christian Dolderer is Lead Research Analyst, Trimble Transportation (Transporeon). He is an experienced expert in transport market analysis and KPI development based in the Stuttgart region.

Christian Dolderer is Lead Research Analyst, Trimble Transportation (Transporeon). He is an experienced expert in transport market analysis and KPI development based in the Stuttgart region.

He is currently working at Transporeon, a leading company for transport management solutions, where he focuses on evaluating transport markets and creating meaningful performance indicators.