Michael Krell appointed CEO of NTG Germany GmbH

Jan 17, 2025 at 9:39 PM

CEO Roberto Cirillo Leaves Swiss Post

Jan 19, 2025 at 9:57 AMThe year 2024 ended with a seasonally slight decrease in freight availability, but the transport demand in Europe remains high. Those looking for truck transports between the years had to dig a little deeper into their pockets and offer higher prices. In 2025, the costs for road freight transport and thus also the transport prices will continue to rise.

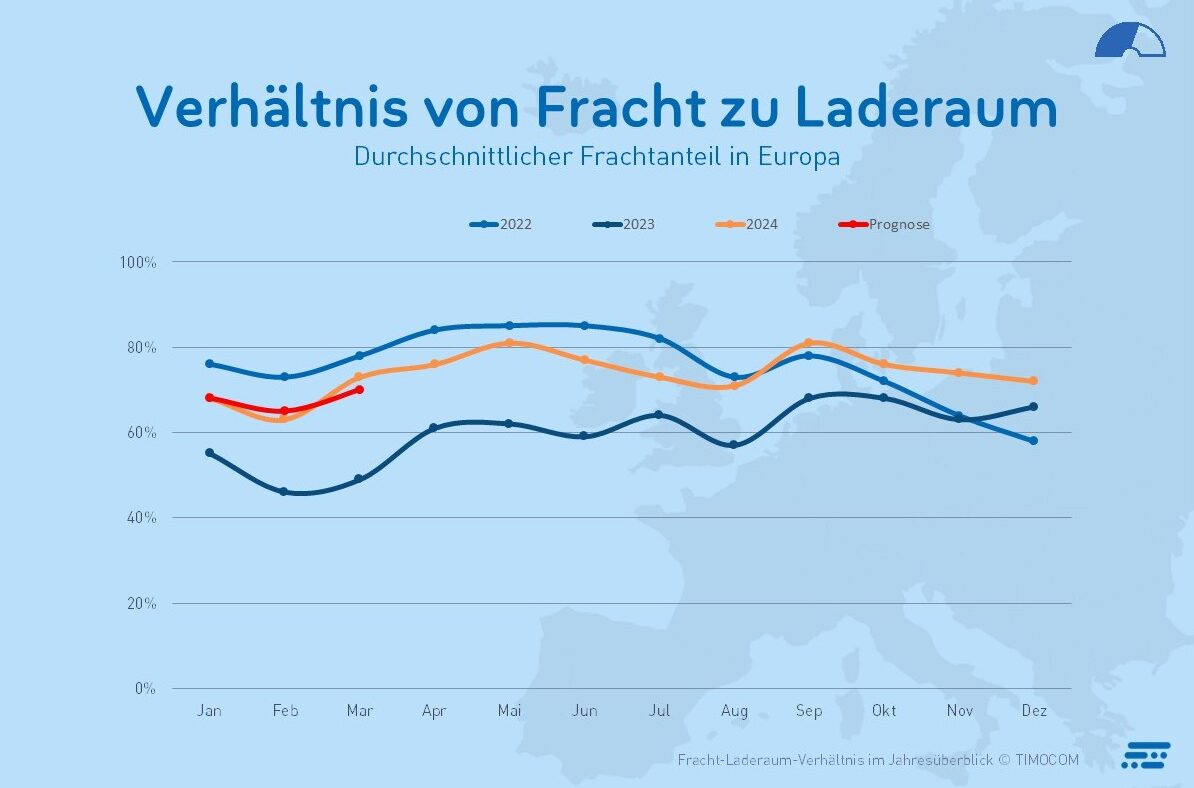

(Erkrath) At the end of the year, the ratio of freight to loading space did not achieve a balance: The freight share remained consistently above 70% until December and outweighed the available truck supply. In the 4th quarter of 2024, there were 79% more freight offers across Europe than in the same quarter of the previous year. The enormous demand has led to an almost doubling of the freight offers posted on the TIMOCOM marketplace in the entire year of 2024 (+92%). According to analyses by Transport Intelligence Ltd., industries such as e-commerce, manufacturing, and retail fueled this demand as companies replenished their inventories and transported goods across borders.

The Transport Market in Germany

In the entire year of 2024, a total of 70% more freight entries were registered in the German domestic transport sector than in 2023. Within Germany, despite the stagnating economic development, a 59% increase in freight offers compared to the same quarter of the previous year was recorded in Q4. “Some freight forwarders and carriers were able to benefit from the Christmas business, but overall, the transport and logistics sector looks pessimistically at the coming months,” says Gunnar Gburek, Head of Business Affairs at TIMOCOM. According to the ifo Institute, only one in eight companies in Germany expects better business in 2025.

12 percent fewer loading space offers than in the previous year

12 percent fewer loading space offers than in the previous year

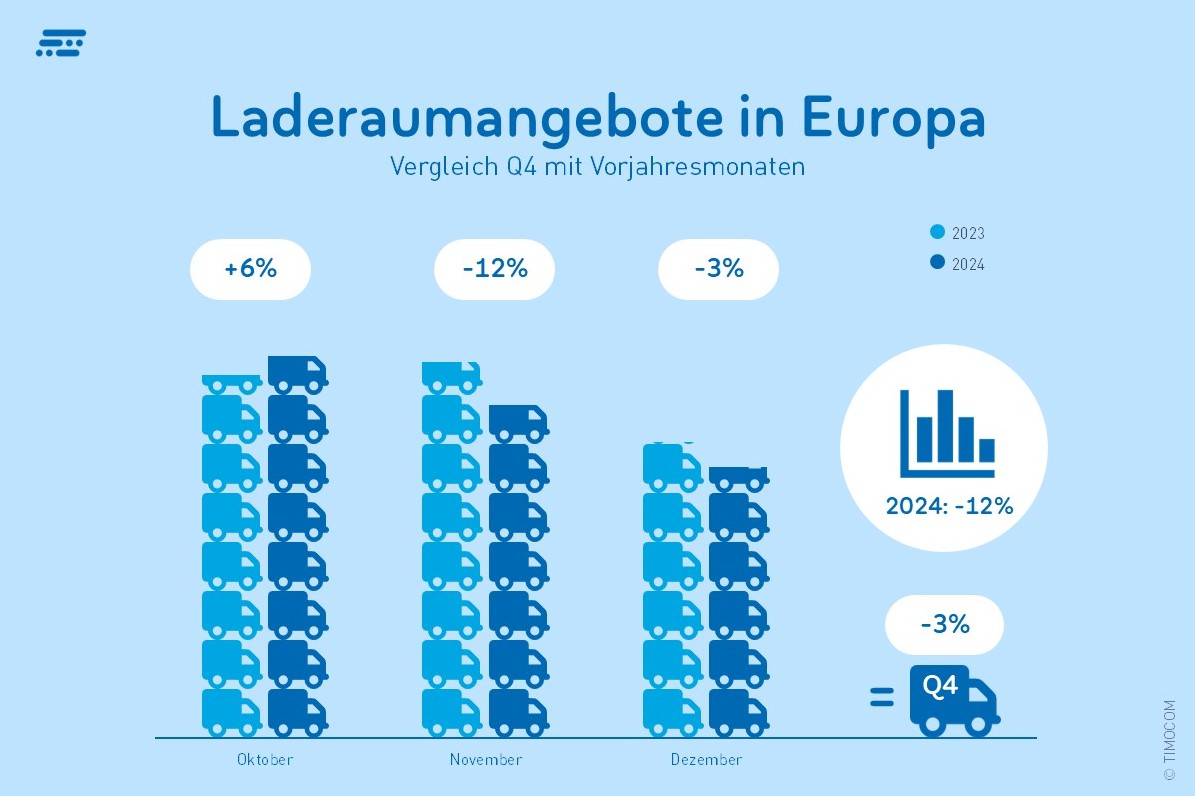

In 2024, the loading space offers posted on the TIMOCOM marketplace decreased by 12% compared to the previous year. Reasons include the long-known driver shortage, which currently limits capacities, as well as increased costs that cannot be passed on. In the strong demand month of October, there was an increase in loading space compared to the same month of the previous year (+6%), but overall, there were 3% fewer trucks on the TIMOCOM marketplace in the 4th quarter than in the same quarter of the previous year.

According to surveys by the Institute for Economic Research (IW), only companies from seven industries plan to hire new employees this year. Among them are freight forwarders looking to expand their personnel resources. “The hope of transport companies for better business weighs more heavily than the generally cautious economic sentiment,” concludes Gunnar Gburek.

In-demand Transport Units in Road Freight Transport 2024

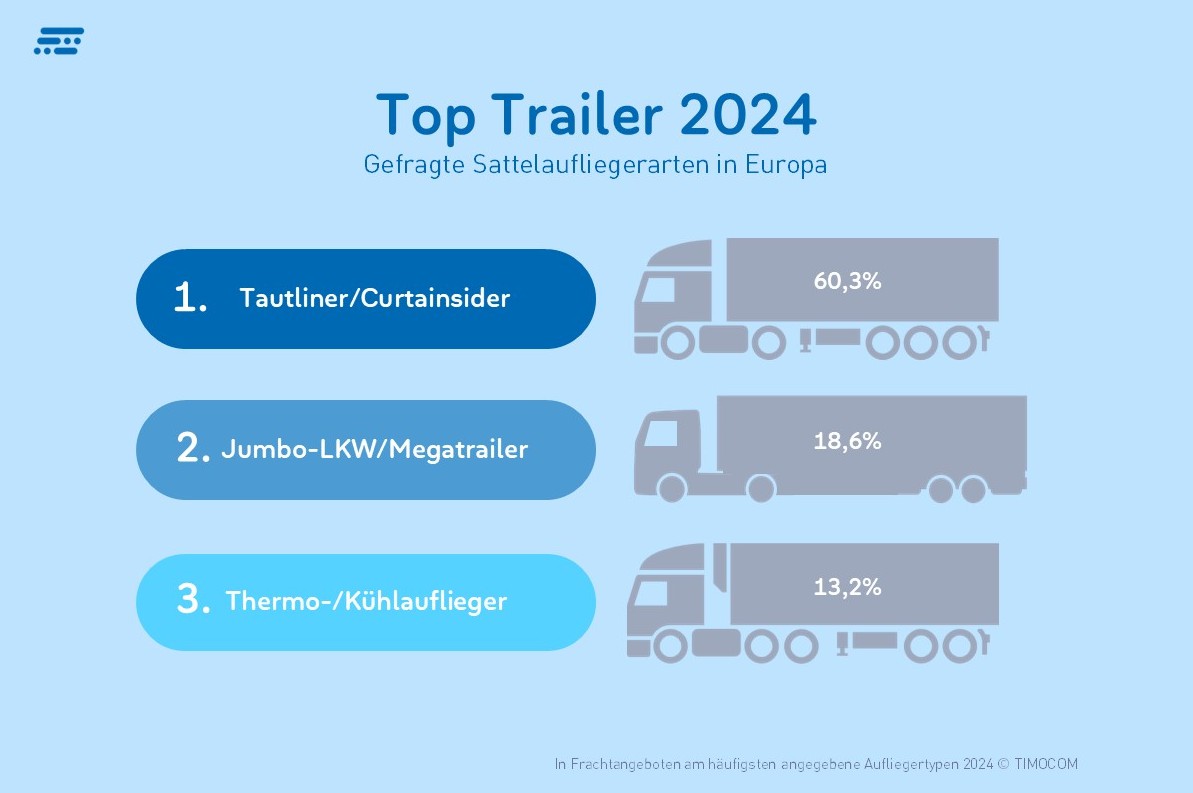

Among the transport units most frequently requested in freight offers in 2024, curtainsiders or tautliners are by far in first place. In 60.3% of the freight offers, these types of semi-trailers were requested last year. In second place are mega trailers or jumbo trucks with 18.6%, closely followed by thermotrucks and refrigerated trailers with 13.2%.

Offer prices and price proposals remain high before the turn of the year

Offer prices and price proposals remain high before the turn of the year

The low availability of loading space makes available truck capacities a valuable commodity. In the logistics industry, prices are hard to negotiate. Depending on the distance and requirements, availabilities and thus the offer price of the clients as well as the price proposals of potential contractors fluctuate. This was very evident in the fourth quarter. The offered transport prices from October to Christmas averaged between €1.44/km and €1.74/km across Europe and rose by about 20% in the last two weeks of December compared to the previous weeks. Therefore, anyone wanting to send a truck with freight shortly before the holiday or on the days between Christmas and New Year’s had to offer a bit more. The offer prices have risen by an average of up to 16.5% across Europe compared to the same quarter of the previous year. The requested price from carriers was on average up to 18% higher than in the same quarter of the previous year. Within Germany, the transport prices averaged between €1.60/km and €1.86/km. Contributing to this were the recently increased costs for diesel.

Positive Trend Continues

For the first quarter of 2025, a high transport demand on the spot market is still expected, as particularly long-term contractual relationships are avoided due to the uncertain future. The freight-to-loading space ratio is expected not to fall below 65:35. “Due to the Easter holidays falling a month later this year, the demand will only pick up again in April, so the freight share will then rise above 70%,” predicts Gunnar Gburek from TIMOCOM. “Transport prices will also rise with increasing demand, not least to compensate for the significantly increased costs of CO2 and toll charges.

Real Growth of 2 Percent for 2025

Analysts from Transport Intelligence expect that the European road freight transport will grow by a real 2.0% in 2025 and reach a value of over €436 billion. “Overall, the outlook for the European transport sector is not as bleak as it seems. However, whether the German logistics companies, which mainly operate domestically, will benefit from this is questionable, as stagnation is currently the case here,” says Gunnar Gburek.

Download the current Transport Barometer here

Graphics: ©: TIMOCOM