According to LogBer, intralogistics begins at the entrance to the company premises

Jul 14, 2023 at 7:32 PM

The TIMOCOM Transport Barometer Shows Unpleasant Data

Jul 15, 2023 at 11:50 AMThe real estate consultant Avison Young sees changed location decisions due to climate. Interestingly for logistics service providers, many industrial and commercial companies are increasing their inventory levels due to climate risks. On the logistics side, the climate, particularly due to the increasingly frequent low water levels in summer, is particularly affecting inland shipping. Changing locations sounds easier than it is. Especially for small and medium-sized enterprises, the risk of losing good employees when moving to another region is high. Moreover, it is not guaranteed that there will be less climate change elsewhere.

(Frankfurt/Main) It is that time again: Low water levels on German rivers have already reduced navigability by mid-June. Transport becomes more complicated and expensive – this could slow down the decline in inflation. Economic recovery could also be hampered.

So far this year, these effects have not been significantly felt. However, last year, the transport volume on German inland waterways was the lowest2) since the German reunification in 1990. One cause was the low water levels in August. From mid to late June of this year, the drought conditions in Germany have once again significantly worsened, and the water levels of the Rhine were already lower than in the drought years of 2018 and 2022.

Are the Effects on the Transport Industry Increasing?

Even though there are currently other significant geopolitical events keeping the economy and society on edge, the consequences of climate change are not diminishing. On the contrary: Its effects, for example on the transport industry and real estate sector, are continuing to increase. Furthermore, parts of the German transport infrastructure and many properties are not designed for climatic changes. Major adjustments will need to be made here.

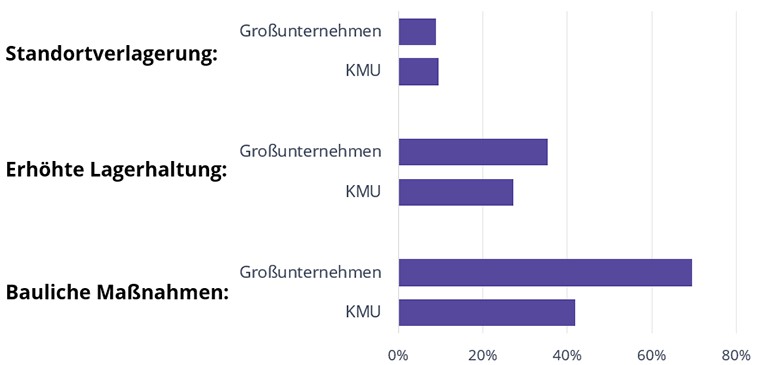

More than three-quarters of German small and medium-sized enterprises (SMEs) and almost 90 percent of large companies expect3) that the effects of climate change (such as extreme weather events) and the transition to more sustainable business practices will impact their operations. The responses of German companies to the increase in climate risks include, among other steps: relocation, increased inventory, and construction measures.

Measures Taken and Planned* Due to the Increase in Climate Risks

*Excerpt (Basis: Survey of German companies in 2022, differentiated by company size. SMEs = small and medium-sized enterprises). Source: Institute for SME Research Bonn, 2023

*Excerpt (Basis: Survey of German companies in 2022, differentiated by company size. SMEs = small and medium-sized enterprises). Source: Institute for SME Research Bonn, 2023

The partly significant percentage differences in adaptation measures can likely be attributed to the fact that they are less easily realizable by SMEs than by large companies. However, the necessary responses, both at the company and overall economic level, also present opportunities: The path to achieving climate goals opens up new business models, such as operational and structural adaptations of existing and future-proof development of new structures. Additionally, in the field of energy supply and usage, or in sustainable procurement and production processes, where the circular economy will play an increasingly important role. The mere desire for protection against climate risks paves the way for far-reaching initiatives: Almost half3) of German companies feel insufficiently protected against a climate risk (e.g., heat, precipitation, drought).

What Does This Have to Do with the Real Estate Sector?

What Does This Have to Do with the Real Estate Sector?

- Climate changes are increasingly being incorporated into corporate location decisions – this applies to industry as well as trade, service providers, and office users. Heat and drought periods threaten smooth production. Moreover, industry and commerce depend on smooth goods traffic and the supply of raw materials and intermediate products. Germany is also dependent on countries that can be heavily affected by the consequences of climate change.

- Real estate investors have long been considering climate risks in their investment strategies.

- Climate change is increasingly leading to extreme weather conditions. This can also cause damage to industrial, production, and logistics properties, resulting in production and delivery failures.

- Office buildings that contribute significantly to lowering temperatures in summer through green roofs and facades help create a more pleasant microclimate and positively impact employee well-being. Additionally, they require fewer air conditioning units, have lower emissions, and incur lower energy costs – a real location argument for users, both currently and in the future.

- Properties, such as data centers, will be increasingly preferred by customers and investors in the future. Until now, they required “huge” amounts of electricity and simultaneously produced large emissions, but will soon be operated CO2-neutrally and be able to become independent of external energy. Since a reliable power supply is one of the most important location requirements for data centers, an autonomous power supply makes these properties more independent in their location choices.

- If goods or intermediate products were previously supplied in a time-critical manner using just-in-time logistics to reduce capital binding, a shift to buffer stocks – to compensate for delivery fluctuations – will require more storage space, and thus also corresponding properties. This will change logistics processes and location requirements for companies, as will, for example, the domestic development of battery and cell expertise in the German automotive industry through a significant expansion of research and development in this country; until now, German car manufacturers have primarily sourced these essential components for electric vehicles from other continents. Regardless of this trend in the German automotive industry and due to the energy crisis, logistics companies are increasingly converting their truck fleets to electric mobility, as seen with Aldi Nord. Additionally, it is observed that companies are increasingly focusing on new locations away from traditional logistics hubs in metropolitan areas that offer more land availability and potential, for example, in transport infrastructure. An example of this is the new logistics center in Neu Wulmstorf, which is being leased prospectively as it offers larger spaces and is located on the expanding A 26. Outside the metropolitan areas, there are even more brownfields that meet the changed requirements of logistics companies for more space. As in other asset classes, there is currently an adjustment process in the logistics industry to the long-term climate goals of the Federal Republic to reduce the CO2 balance, for example, through the transition to electric mobility, greening of properties, or the use of photovoltaic systems.

1) The map officially titled “Drought Total Soil” represents the soil moisture index in Germany up to a depth of about 1.80 meters in five categories. The current soil moisture is exceptionally low in long-term comparison.

2) Federal Statistical Office, 2023

3) Institute for SME Research, 2023

Title photo: © Loginfo24

Graphics: © Avison Young