KION Group Enters Hydrogen Drive Manufacturing

Jan 12, 2023 at 4:55 PM

Spare Parts Logistics of Mercedes-Benz Trucks to be Based in the Harz Region

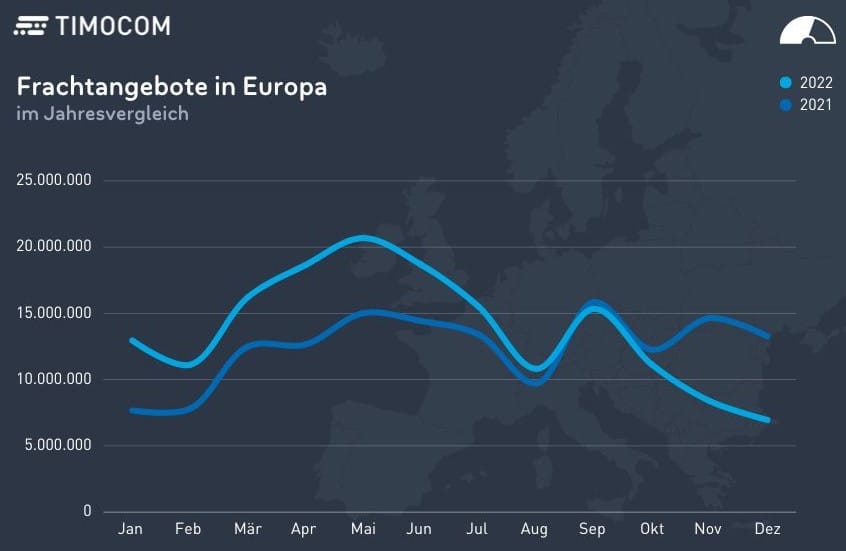

Jan 13, 2023 at 3:12 PMThe TIMOCOM Transport Barometer shows a significant decline in freight offers in the fourth quarter of 2022, indicating a downward trend in demand for cargo space. Across Europe, the offers listed in TIMOCOM’s freight exchange decreased by 36 percent compared to Q3. The fourth quarter thus marks a turning point in the European transport market, following a first half characterized by massive freight surpluses.

In Germany, a similar development can be observed. Here, there were even 39 percent fewer freight offers than in the previous quarter. While stagnation in freight offers in the Federal Republic began as early as June, this became evident in the European average only in September.

Transport capacities secured early

The strongest decline is noticeable in December. In Germany, available offers decreased by 55 percent compared to the previous year. Across Europe, there were 48 percent fewer freight offers compared to December 2021. Overall, however, in 2022, 12 percent more freight offers were listed in TIMOCOM’s marketplace across Europe than in 2021. Within Germany, there were only 2.5 percent more freights in 2022 than in the previous year.

Different speeds in the decline of freight offers

The seasonal peak and subsequent drop in freight offers is not unusual. But what is the cause of the different speeds in the changes at the end of the year?”This year’s development in road freight transport is characterized by a shortage of drivers and capacity as well as delivery bottlenecks. Additionally, there was a significant increase in inflation and the looming recession. This has led many clients to rethink,” says Gunnar Gburek, Head of Business Affairs at TIMOCOM. Many companies have already taken care of transport capacities in advance and secured them early for the seasonal business. This slowed down the pre-Christmas freight volume in our marketplace, which fell below the level of the previous year. Furthermore, the holidays this year fell on a weekend, which created more available capacities in the entire previous week and led to lower demand between the years. In November, a large part of the foreseeable scheduled transports had already been allocated. Accordingly, no short-term transport providers needed to be sought for these,” interprets Gunnar Gburek. “Moreover, there is a growing tendency to conclude long-term contracts with service providers,” the company spokesperson continues. “Demand will continue to decline in the first quarter of 2023 and lead to a relaxation of transport prices. In the long term, prices for road freight transport will settle at a higher level than in 2021 due to toll fees, diesel floaters, and increased personnel costs.”

Fewer transports between France and Germany

The largest declines in the fourth quarter were observed in transports from Belgium (BE) to Germany (DE) as well as from France (FR) to Germany and vice versa. Especially the latter are two countries that represent one of the most significant trading partners for each other in Europe. The foreign trade between Germany and France remained stable until October, despite the energy crisis and inflation. However, in November, demand from abroad significantly decreased according to the Federal Statistical Office. EU countries ordered 10.3 percent and third countries 6.8 percent fewer goods in the Federal Republic. Domestic demand fell by 1.1 percent. In contrast, freight from Spain (ES) destined for France increased in the fourth quarter compared to the previous year. In October, there were 15 percent and in November 22 percent more freight offers in TIMOCOM’s marketplace. In December 2022, the freight volume on this route reached the same level as in 2021.

Freight offers in Poland stable

The freight volume of the Eastern European country somewhat defies the negative trend across Europe. In the fourth quarter, there were 6 percent more freight offers in Poland than in the previous year. The freight volume only moderately decreased by 7 percent in the fourth quarter compared to the previous quarter – but remained at a high level compared to changes in other European countries. Foreign trade in Eastern Europe increased. The freight volume from Poland to Romania significantly rose in the fourth quarter compared to the previous year. In October, 89 percent more freight offers were listed in TIMOCOM’s marketplace. In November, there were 7 percent more than in the previous year, before a significant decline in offers of 42 percent was recorded in December.

Only a slight increase in cargo space offers compared to the previous year

Compared to the previous year’s quarter, there were 8 percent more cargo space offers available than in Q4 2021. The cargo space entries listed in TIMOCOM’s freight exchange fluctuated slightly throughout the year 2022 due to seasonal changes compared to freight offers. “Despite the decline in freight offers, the cargo space availability has hardly changed compared to the previous year,” analyzes Gunnar Gburek the development. After an increase of 16 percent in the first quarter, the number of listed cargo space offers fell by 8 percent in the second quarter compared to Q1. In the third quarter, there were 2 percent more vehicles, while in the fourth quarter, the available cargo space offers remained statistically unchanged compared to the previous quarter. Only in December did the number of trucks found in the freight exchange decrease.

Ratio of freight to cargo space again seasonally influenced

The share of freights compared to cargo space offers was significantly above the exceptional year 2020 and fell below the end-of-year value of that year for the first time due to the recession at the end of the year. The first days of the new year confirmed the trend from December 2022. “It will be interesting to see what happens in the next high season. Traditionally, freight offers increase again before Easter. Presumably, the ratio of freight to cargo space will remain significantly more seasonally influenced, as it was before Corona,” predicts Gunnar Gburek. According to the ifo Institute, Germany’s export expectations rose from 0.9 points in November to 1.6 points in December. The further development depends on the global economic situation. However, experts from the German Chamber of Industry and Commerce expect a further decline in exports in 2023, as reported by Handelsblatt in December. Not only Germany has been purchasing less from abroad since the end of 2022. The freight volume in domestic transport could therefore increase relatively more in 2023 and further highlight the driver shortage in the country. Digital tools and online marketplaces can significantly support logistics in planning better and responding flexibly and long-term to market changes.

Photo: © TIMOCOM / Image caption: Freight offers in Europe 2022 and 2021 in annual comparison