German Logistics Congress by BVL will only take place digitally

Oct 13, 2020 at 3:08 PMDHL Freight Ensures Green Logistics in Road Freight

Oct 14, 2020 at 7:30 AMZetra International, specializing in M&A in the logistics sector, based in Zurich and Basel, publishes an overview of the Swiss M&A market in 2019 with the most important transactions. Zetra also provides a forecast for the near future of the industry.

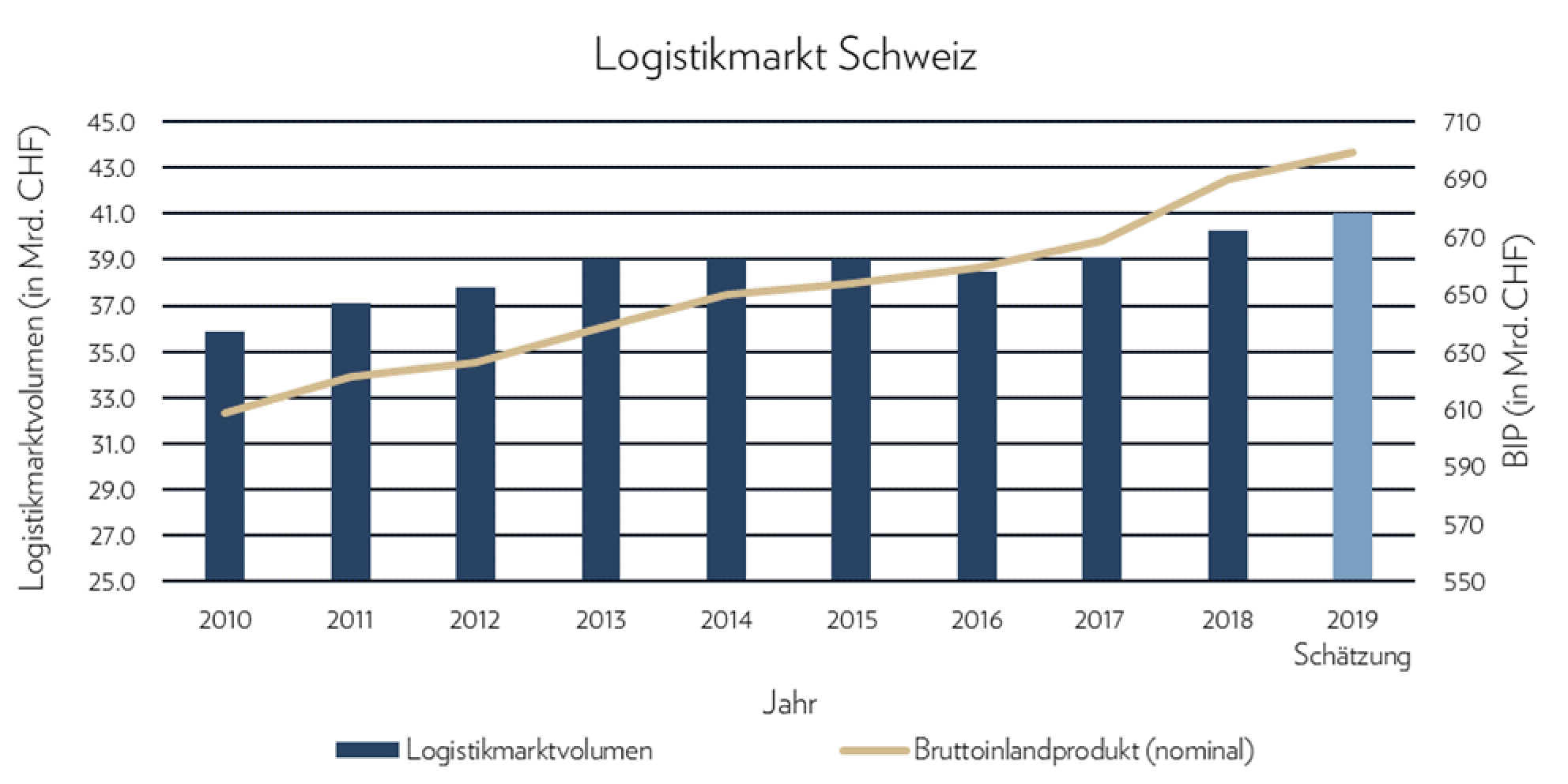

(Basel) Growth in the Swiss logistics market slowed down in 2019 due to lower economic growth in Switzerland and neighboring countries (GS1 Logistics Market Study Switzerland 2020). Revenue declines are expected for 2020, but the severity of these declines remains uncertain.

After strong growth of 3.1% in the logistics market volume in 2018, a moderate increase of 1.9% to 41 billion CHF is expected in 2019 (GS1). This is attributed to the growth rate of the Swiss GDP. The State Secretariat for Economic Affairs (SECO) forecasts a GDP increase of 1.3% for 2019. Thus, economic growth is slowing compared to the previous year (3.2%). The neighboring countries of Switzerland also show moderate growth rates. The declining growth and the strong Swiss franc burden logistics-oriented sectors and explain the lower increase in logistics-related services in 2019.

SECO Predicts Decline in GDP

Due to COVID-19, SECO expects a GDP decline of 6.2% in 2020. Based on the assumption that GDP and the logistics market are closely linked, Bernstein Research anticipates a 15% decline in land freight in Europe.

Sea freight is suffering from a similar downturn. The logistics container throughput index of RWI/ISL recorded a record drop in February and has not significantly recovered since then. In May 2020, the index value stands at 107.7 points, 7.3% below the previous year’s value. Kuehne + Nagel also reports slowdowns in loading and unloading ships due to reduced working hours of dockworkers. These measures were implemented at Italian ports to comply with COVID-19 regulations and are likely to lead to delays in Swiss deliveries.

The appearance of a booming online trade is also misleading. During the lockdown, stores had to close largely, forcing consumers to turn to e-commerce channels. The Swiss E-Commerce Report 2020 predicts a revenue increase in online trade of up to 30% by the end of the year. However, contract logistics has not been able to benefit from this trend so far. The shift from B2B to B2C distribution channels leads to higher costs and lower margins for logistics companies. An example of this dynamic is the world-leading contract logistics provider Kuehne + Nagel, which reported a revenue decline of 11.3% in this area in the first half of 2020 compared to the previous year.

19 Significant M&A Transactions in 2019

In the transport and logistics market, there were 19 significant M&A transactions involving Swiss participation in the last twelve months. The impact of COVID-19 is clearly visible. With only two transactions between February and mid-May, a sharp decline in M&A activities was recorded. Since then, as global easing measures have been implemented and the economy has partially recovered, more transactions have been made in the Swiss transport and logistics sector. Larger transactions, such as CEVA Logistics’ acquisition of the African AMI Worldwide Limited, are also taking place. CEVA is acquiring around 1,000 employees and can thus strengthen its presence in East and Southern Africa.

In the second half of 2020, the M&A market could recover. Many deals were interrupted due to COVID-19 and postponed to the second half of 2020, as reported by NZZ. An example of this could be the minority stake of the Mediterranean Shipping Company (MSC) in the Italian Gruppo Messina. The transaction was announced back in June 2019 and had to be delayed once already.

Source: GS1 Switzerland Logistics Market Study 2020, SECO, RWI/ISL, FuW, Swiss E-Commerce Report 2020, Merger Market, Capital IQ, NZZ, ZETRA Analysis

The Six Most Important Mergers

Among the 19 transactions in the Swiss logistics and transport market over the last twelve months, six deals stand out as highlights:

- The acquisition of Nova Traffic by the Schneider Group, which is a portfolio company of the Swiss private equity group Invision.

- Acquisition of Air-Glaciers by Air Zermatt, bringing together two leading Swiss helicopter companies.

- The acquisition of a minority stake in Swissterminal Holding by DP World, which will enhance logistics capabilities in Europe.

- Fastlog acquires the supply chain business of DHL Logistics (Switzerland) and complements its ICT core competencies with a large physical network.

- The opening of the shareholding of SBB Cargo to Swiss Combi AG, a joint venture supported by Camion Transport, Planzer, Bertschi, and Galliker.

- The international expansion of Kuehne + Nagel through the acquisitions of the land transport and logistics activities of Rotra Forwarding, the Austrian Jöbstl company, and Worldwide Perishable Canada.

About ZETRA

As part of the global M&A network Global M&A, ZETRA, together with its partner firms, has valuable experience in the field of transport & logistics. Since 2010, members of Global M&A have completed 42 deals in this area, twelve of which were accompanied by ZETRA.

Graphic: © ZETRA

Photo: © Adobe Stock