Dollars and belly cargo for blended wings

Feb 10, 2026 at 4:04 PM

“EPG AURA”: Logistics software with AI

Feb 11, 2026 at 10:30 AMGlobal air freight volumes recorded a 7% increase in January 2026 compared to the previous year, attributed to an earlier start of the Lunar New Year. This development led to a temporary boost in demand, while freight rates experienced a slight decline of 1% to $2.56 per kg. However, the first declines in e-commerce exports from China since January 2022 dampen initial market optimism, as analysts from Xeneta report.

Market Dynamics and Capacity Utilization

In January 2026, global cargo weight in the air freight sector increased more than capacity, which rose by 5%. This resulted in a one percentage point increase in the global dynamic load factor to 57%. Niall van de Wouw, Chief Airfreight Officer of Xeneta, emphasizes that the positive development in the air freight market should be viewed with caution. The impact of the Lunar New Year on exports from Asia complicates drawing clear conclusions about market development.

The festivities began on January 28, 2025, while this year they start on February 15. Therefore, much of the strength in air freight volume could be calendar-related.

Decline in E-Commerce Exports from China

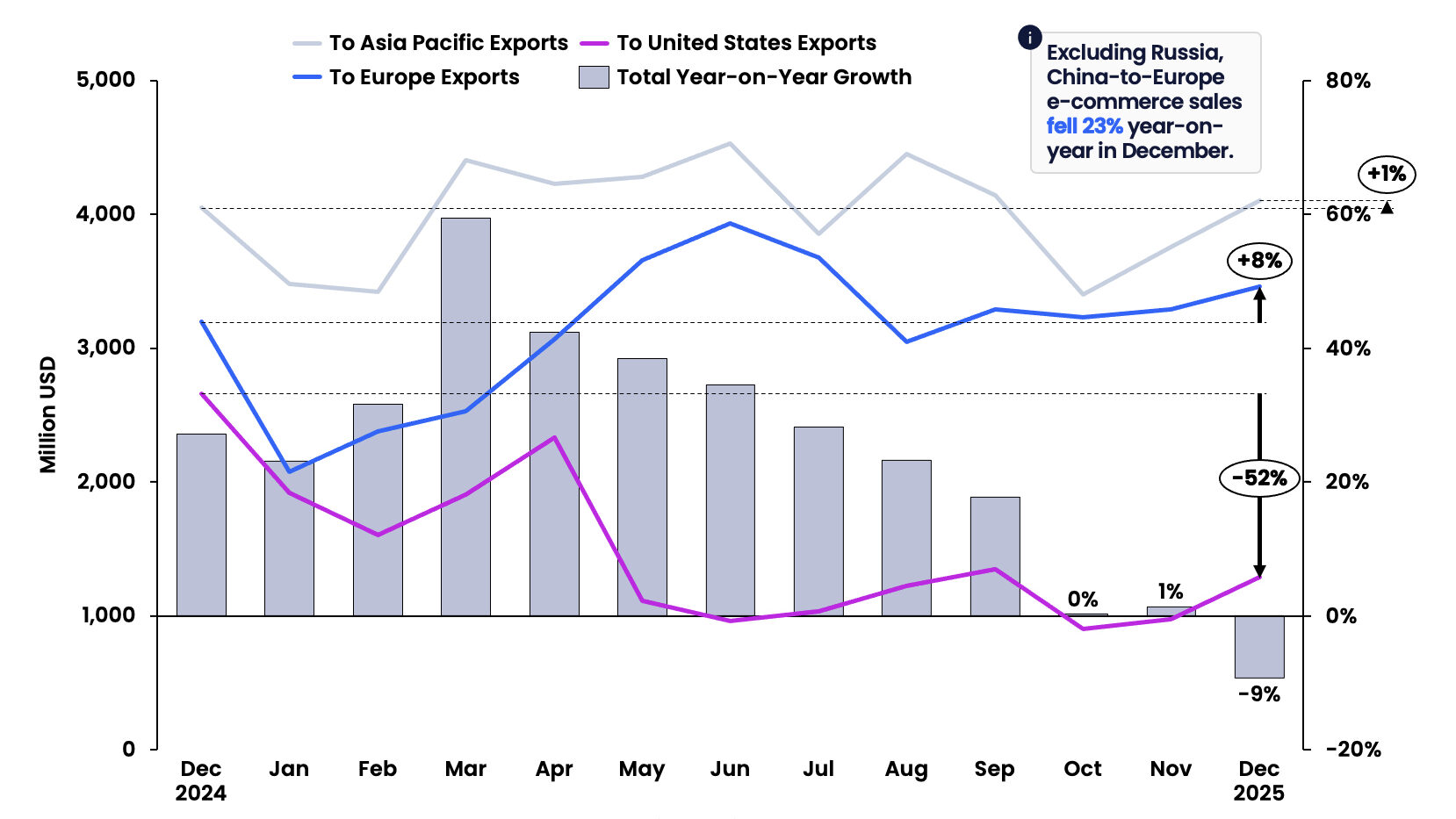

A crucial factor influencing air freight volumes will be the decline in e-commerce exports from China and Hong Kong. The latest data from Chinese customs authorities show a 9% decrease in e-commerce exports in December 2025 compared to the previous year, marking the first decline since January 2022. This development is particularly relevant as the air freight market is heavily reliant on cross-border e-commerce, which accounts for about 20-25% of the annual total volume.

E-commerce exports from China to the U.S. saw a decline of over 50% in December, attributed to the introduction of a U.S. de minimis ban. Throughout 2025, e-commerce exports fell by 28% compared to the previous year. While major Chinese e-commerce platforms are attempting to expand their market share in Europe to offset higher export costs to the U.S., current figures indicate that this strategy is also under pressure.

Impact of Regulations and Market Conditions

Regulatory measures could further burden e-commerce exports. These developments pose a challenge for air freight, which relies on reliable demand.

Additionally, the situation in container traffic in the Red Sea and the Suez Canal remains an unpredictable factor for air freight growth. Carriers such as CMA CGM and Maersk have begun testing Suez Canal routes on selected voyages, indicating a possible normalization. Nevertheless, any disruption could lead some sea freight companies to revert to air freight in the short term.