HGK and Salzgitter christen dry cargo ship “Blue Marlin”

Jul 4, 2025 at 5:51 PM

Torwegge Offers Secure In-House Transport of Load Carriers

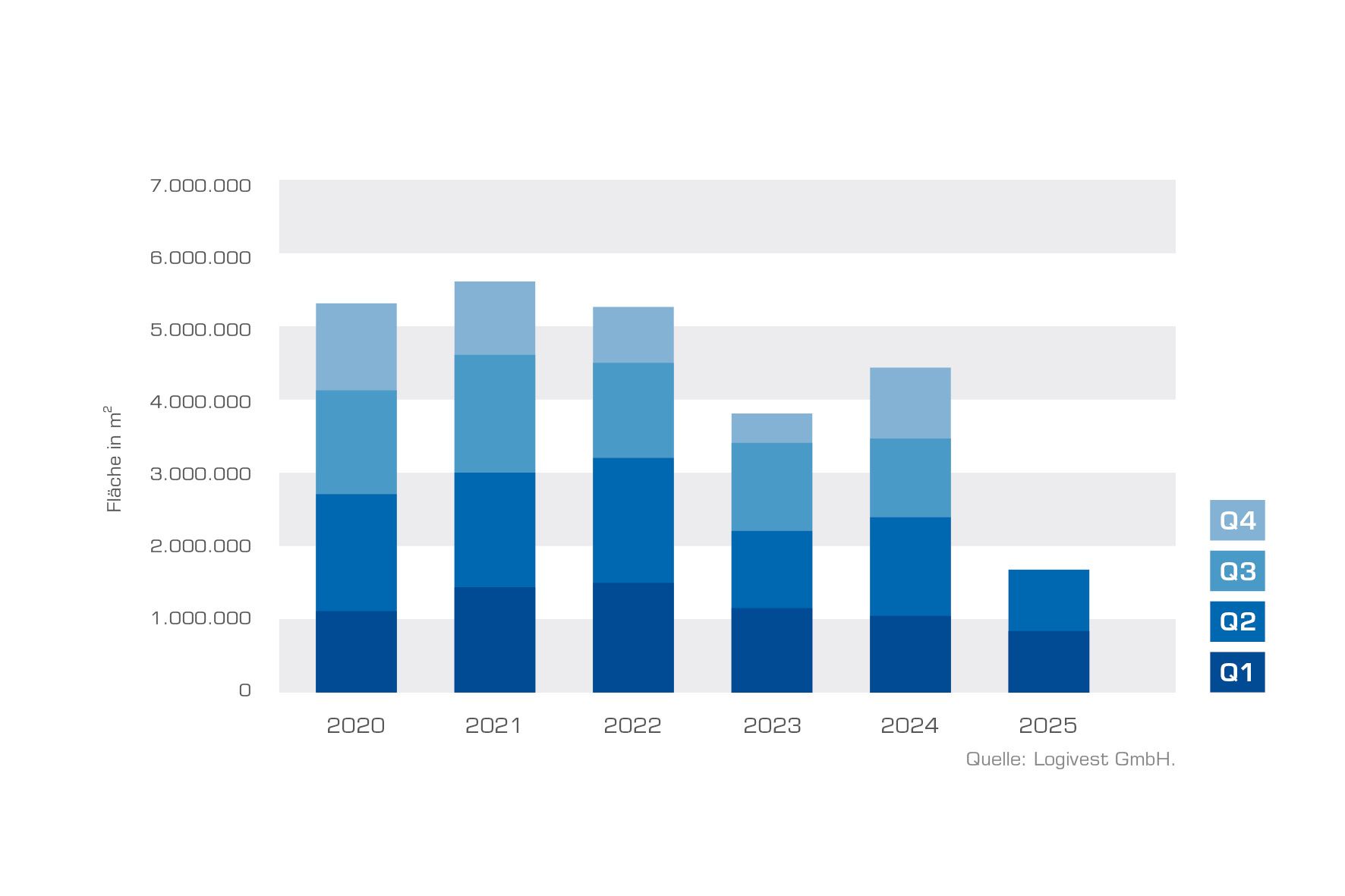

Jul 8, 2025 at 4:37 PMWith around 1.7 million square meters of new construction volume, the German logistics real estate market recorded the weakest half-year result in the last five years. This is reported by the holistic logistics real estate consultant Logivest after evaluating its own research data. The basis of the data is always the time of the groundbreaking.

(Munich) “With around 850,000 square meters in the first and just under 830,000 square meters in the second quarter, we cannot continue the positive trends of 2024. With a grey market of around three million square meters and vacancies in existing properties of over eight million square meters, new developments are under massive competitive pressure,” says Neumeier. However, even though the half-year figures in recent years were often significantly above the two-million mark, the expert emphasizes that it is important not to speak of a market crash. “Looking at the figures from the last ten years, we see that we have simply fallen back to a pre-Corona level. In 2019, we had a similar result – in the years before, we were even significantly below that in some cases.”

Swabia Takes the Top Position

There is a surprise among the top logistics regions of the first half of the year. The Swabia region, previously positioned in the lower third, has risen to the top. With around 210,000 square meters, the region has more than doubled its result from 2024 in the first half of the year. A key factor is a project by Dietz AG in Langenau. With around 63,000 square meters, the built-to-suit property for the winkler Group is the third-largest development of the first half of the year. Additionally, the speculative development by Frasers Property Industrial in Günzburg contributes to the region’s top ranking with around 50,000 square meters, spread across several halls.

In second place is the Berlin/Brandenburg logistics region, which has also nearly doubled its annual result from 2024 with 190,000 square meters of new construction space. The currently largest project in the region is the Panattoni Park Berlin East II in Grünheide with around 55,000 square meters, followed by the speculative development of the MLP Group in Spreenhagen with just under 35,000 square meters. In third place is Duisburg/Niederrhein, one of the absolute top regions, which shows a solid half-year result with around 175,000 square meters. With just under 72,000 square meters, the MLP Business Park Schalke is not only the largest development in the region but currently in all of Germany.

While Munich or Mitte D no longer make it into the top ten, the Upper Rhine region can maintain its position in the upper third in the first half of 2025. A key factor is the second-largest project of the first half of the year – a development of around 65,000 square meters by Logad GmbH for Galaxus in Neuenburg. This allows the Swiss online retailer to expand its location to a total of approximately 90,000 square meters.

Light Industrial Gains Importance

Positive prospects are emerging in the light industrial market. This sector can already show a significant increase compared to the previous year’s result with around 310,000 square meters[1]. The largest project here is a self-developed property by Körber Technologies in Hamburg, covering around 50,000 square meters. In 2024, Logivest first included the category of light industrial properties in its data, thus addressing the growing market.

“The increasing number of light industrial projects shows that Germany’s production location is still quite attractive. And even in logistics real estate, the pipeline remains well filled. Now it depends on how the global economy develops and how politics in Germany, but especially in Europe, acts,” says Neumeier.

[1] The value refers solely to light industrial properties and is not included in the 1.7 million square meters of new construction volume.

Graphic: © Logivest / Photo: © Loginfo24