Carbon Visibility Now Available for All Customers of the Transporeon Platform

Jul 25, 2022 at 3:40 PM

Hermes tests cross-border parcel transport by rail freight

Jul 25, 2022 at 3:50 PMThe market for the rental and owner-occupation of industrial and logistics properties as well as commercial parks in North Rhine-Westphalia has experienced a significant downturn in the first six months of the current year compared to last year’s record. According to Realogis – the leading real estate consulting company for industrial and logistics properties and commercial parks in Germany with 70 experts – the total space turnover achieved by all market participants in the first half of 2022 in the top markets of Düsseldorf, Cologne, and the Ruhr area amounts to a total volume of 519,500 m².

(Düsseldorf) “After the record of 648,000 m² in the same period last year, the strongest half-year in our records, turnover in the first half of 2022 has decreased by 19.8%, and all sub-markets are reporting losses,” comments Bülent Alemdag, Managing Director of Realogis Immobilien Düsseldorf GmbH. “However, the current result represents the second strongest half-year of the past five reporting periods. This is also reflected in the 5-year average, which stands at 515,600 m² and has even been surpassed by 0.8% with the current closing.”

According to Realogis, Düsseldorf accounts for 126,100 m² of the total turnover in NRW, Cologne for 129,200 m², and the Ruhr area for 264,200 m². The largest contract closures in H1 2022 can be attributed to the Ruhr area with ITG over 50,000 m², JW Fulfillment over 28,000 m², and C&K Logistik over 26,900 m². The largest closure in the Cologne market area is Hammer GmbH & Co. KG with 30,000 m², while in the Düsseldorf area, it is the trading company Picnic with 20,000 m².

In particular, rentals in existing spaces have accounted for 310,600 m² or 59.8% of the total half-year closing, followed by new construction spaces with 208,900 m² or 40.2%, according to the market report.

Only one owner-occupier contract closure

Tenants who have rented spaces not owned by them account for the lion’s share with 480,600 m² (92.5%). The only sub-market with owner-occupier closures is Cologne, where Siewert & Kau will utilize over 23,000 m² and OFFERGELD around 14,000 m².

When looking at the space turnover of the sub-markets related to third-party used properties, the Ruhr area stands out with 264,200 m² or 55% among the space providers, followed by Düsseldorf with 126,100 m² or 26.2% and Cologne with 90,300 m² or 18.8%.

Big-box logistics almost responsible for 50%

Big-box rentals – i.e., the large-area segment starting from 10,000 m² with the main usage type of logistics and a maximum office share of 20 percent – have significantly contributed to the total turnover with 348,200 m² or 67%, while commercial parks accounted for only 38,700 m² or 7.4%. Other spaces that are neither classified as big-box nor commercial parks made up 132,600 m² or 25.5%.

The largest share of big-box rentals comes from the Ruhr area with 171,500 m² or 49.3%, followed by Cologne (103,600 m² or 29.8%) and Düsseldorf (73,100 m² or 21%). Düsseldorf, on the other hand, leads in contract closures in commercial parks with 18,400 m² (47.5%). Cologne has 11,100 m² (28.7%) and the Ruhr area has 9,200 m² (23.8%). Other standalone spaces that are neither big-box nor commercial parks account for 83,500 m² (63%) in the Ruhr area, 34,600 m² (26.1%) in Düsseldorf, and 14,500 m² (10.9%) in Cologne.

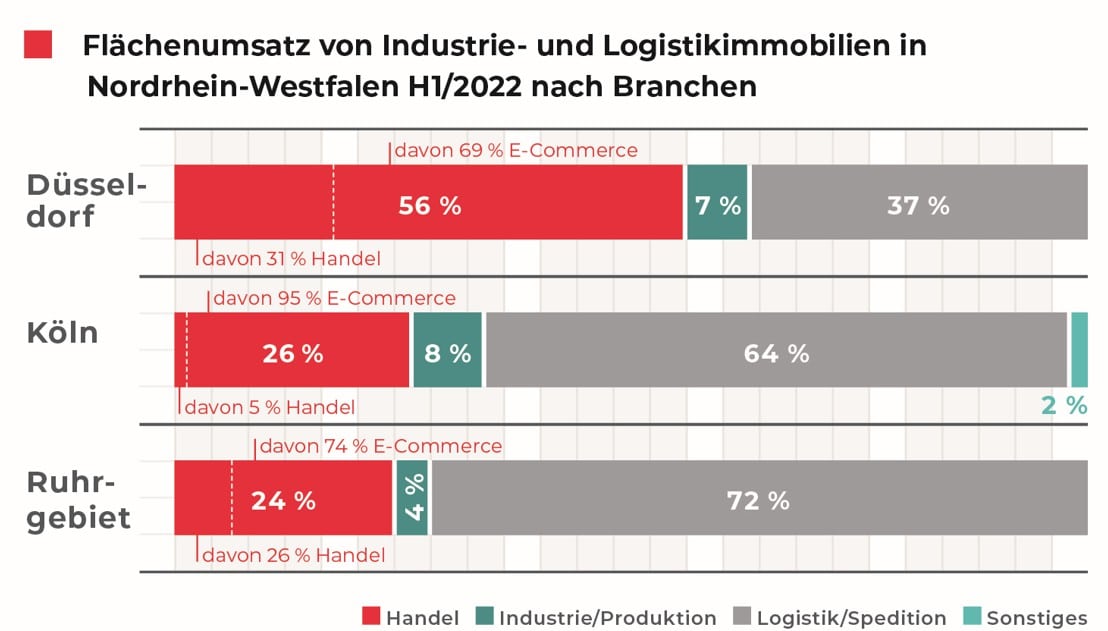

Industry ranking: Trade now only in second place

After trade was responsible for every second square meter of space reduction in the previous year, the logistics/transportation industry has regained the majority of all available properties and is gaining in importance both absolutely and relatively (+28.2 percentage points). With 318,600 m² or a share of 61.3%, almost two out of three implemented square meters belong to this industry (H1 2021: 244,420 m² or 37.7%). The largest closures in this category and reporting period have been made by ITG (50,000 m²), Hammer GmbH & Co.KG (30,000 m²), JW Fulfillment (28,000 m²), and C & K Logistik (26,900 m²).

Currently in second place is the previously first-ranked trade with 167,800 m² and a share of 32.3% (H1 2021: 336,250 m² or 51.9%), which has decreased relatively by -19.6 percentage points. Within the trade category, e-commerce holds the largest share with 127,600 m² or 76%, followed by traditional trade with 40,200 m² or 28%. The ranking of the top deals in this category is led by Deichmann (24,226 m²), followed by Siewert & Kau (23,000 m²), Picnic (20,000 m²), Galaxus (14,000 m²), and NSB Polymers (7,000 m²).

The industry/production sector has not recorded any major closures but is responsible for a space turnover of 31,200 m² (6% of total turnover) (H1 2021: 31,490 m² or 4.9%). Currently, the last place is held by the miscellaneous category with 1,900 m² or 0.4% (H1 2021: 35,840 m² or 5.5%).

Photo: © Realogis