Lufthansa Cargo Sets Future Course for Frankfurt Air Freight Center

Apr 24, 2021 at 6:16 PMSascha Bengel Leads Western Hemisphere at VTG Project Logistics

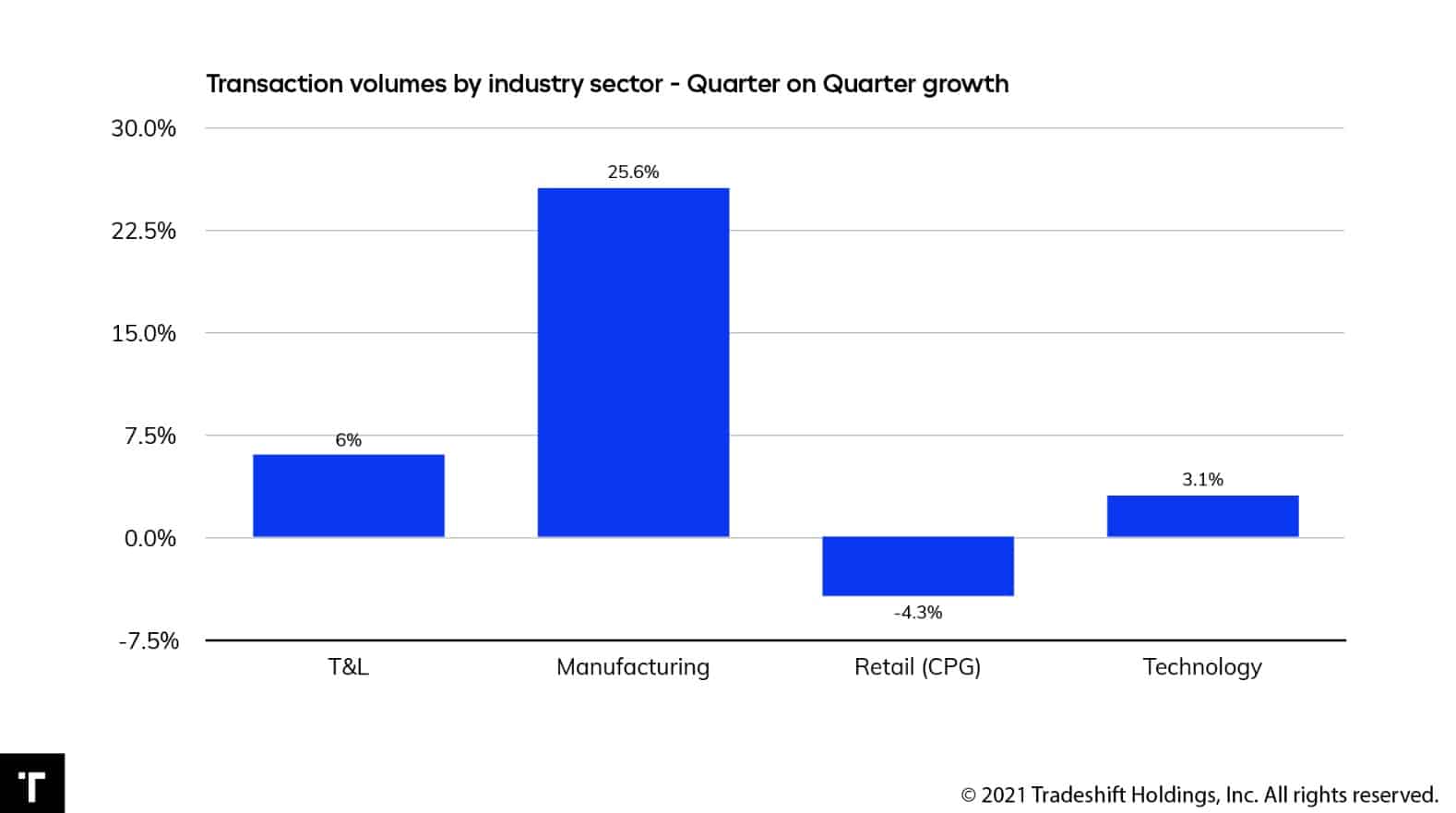

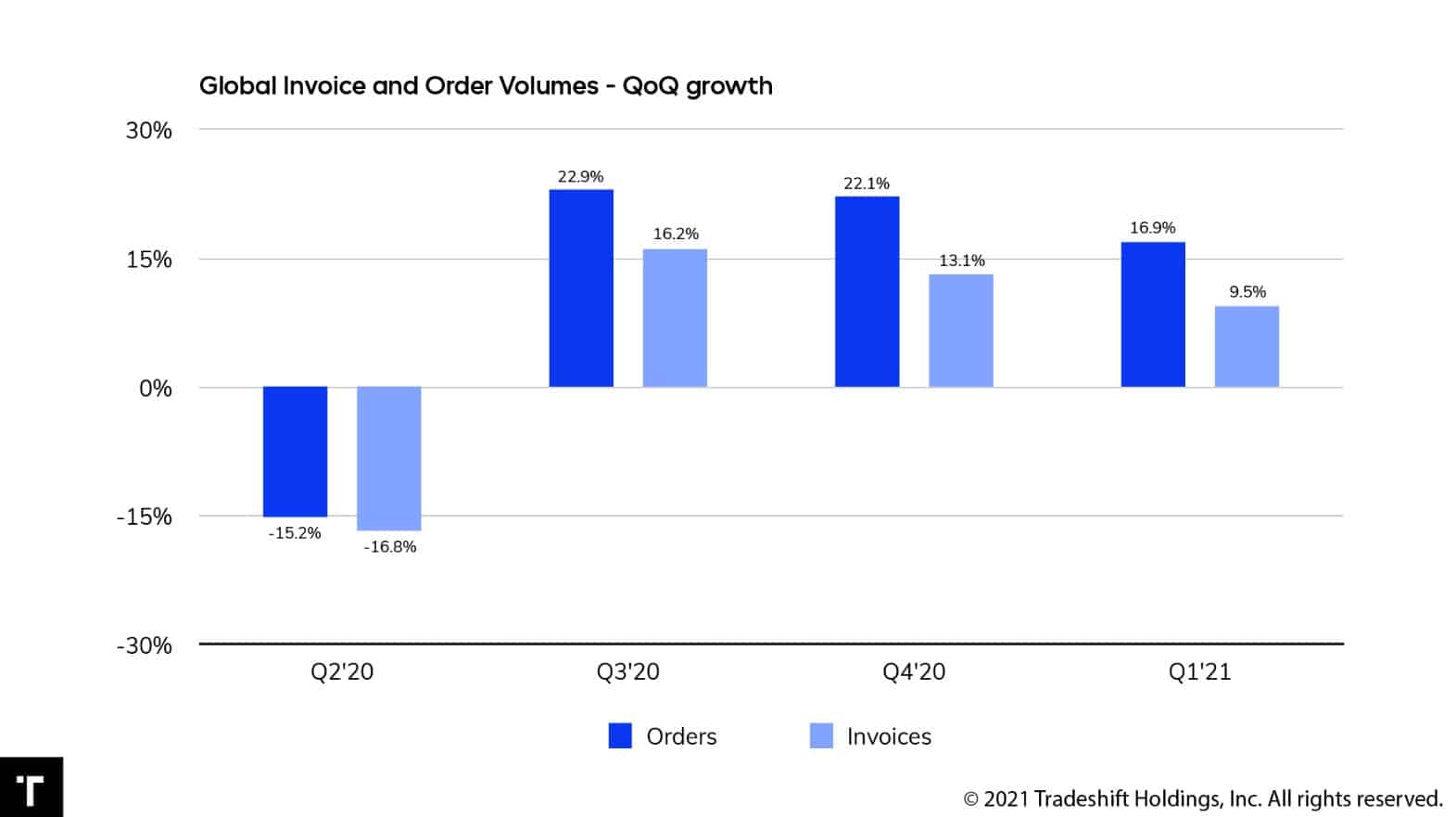

Apr 26, 2021 at 3:53 PMCompared to Q4 2020, the transport and logistics sector recorded a stable increase of 6 percent. Global B2B trade across sectors rose by 10 percent in Q1 2021, and the order volume increased by 16.9 percent. One in five suppliers reports difficulties in managing the rising demand. Almost a third of suppliers have experienced a deterioration in their cash flow position over the past six months. This is shown by new transaction data from Tradeshift.

(San Francisco) According to the latest Index of Global Trade Health from Tradeshift, the order volume increased by 16.9 percent in the first quarter, and one in five suppliers is concerned about keeping up with demand. The strain on supply chains is particularly acute among manufacturers. Order volumes in this sector rose by 80 percent in March compared to the previous year, but invoice volumes grew by only 20 percent during the same period.

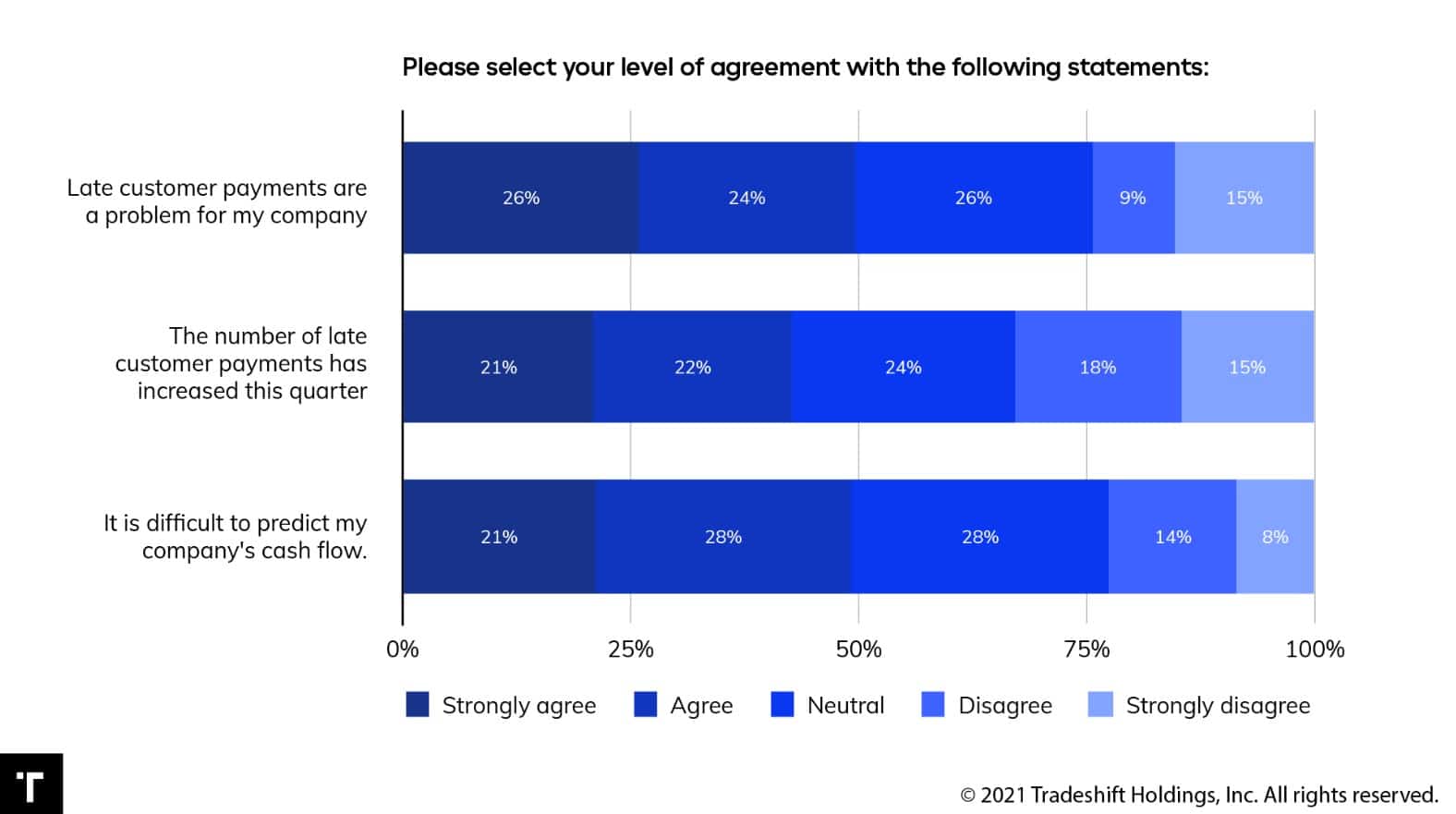

The emerging delta between orders and invoices suggests that working capital is not flowing to suppliers to support the sudden spike in customer demand. In a survey of suppliers, Tradeshift found that nearly a third of respondents reported a deterioration in their cash flow position over the past six months. Almost half indicated that the number of late customer payments has increased since the beginning of the year.

Many Suppliers Are Still Struggling

“The pattern we see in our data suggests that supply chain activity is beginning to find a level that is currently set at a hundred miles per hour,” said Christian Lanng, CEO of Tradeshift. “Many suppliers have been left battered by the events of the past year. Now they are being asked to run a marathon without fuel in the tank. It’s no wonder that cracks are starting to show.”

Recent data from IHS Market indicates that factories in the core countries of the Eurozone have been operating at a record pace in 2021. Tradeshift’s own analysis shows that total transaction volume in supply chains in the EU region increased by 14.5 percent in the first quarter. Transaction volumes in the U.S., which had risen by 29 percent in Q4, fell back to the global average with a 10.2 percent increase in Q1.

Trade Activities in the UK on the Verge of Improvement

In the UK, transaction volumes have significantly declined since the pandemic. However, there are signs that trade activity may be turning a corner. An increase in transaction volume of 6 percent in the first three months of 2021 brought supply chain activity back to pre-pandemic levels in Q1 2020.

“A year ago, COVID disrupted global supply chains. Today, the recovery surge is causing further disruptions,” Lanng continued. “The lack of transparency in supply chains makes them extremely vulnerable to volatility. Digitalization enables companies to build more resilient, collaborative supply chains. But we need to think much further: It’s not just about improving transparency along the supply chain for the buyer, but also about implementing systems that support suppliers and create value for both buyers and suppliers.”

About the Tradeshift Index of Global Trade Health

Many of the world’s largest buyers and their suppliers use Tradeshift’s trade technology platform to exchange digitized purchasing and invoicing data. The index analyzes anonymized transaction data flowing through the platform. It provides a timely overview of how external events impact business-to-business trade. Additional surveys and customer interviews complement the report. The current index is available on the Tradeshift website.

Title photo: © Rosenmund/Pixabay

Graphics: © Tradeshift