The Club of Logistics Plans Its Congress as an In-Person Event

Oct 21, 2020 at 8:51 AMRhenus Relies on Dock’n’Deliver – 1,500 Kilograms with a BE Driving License

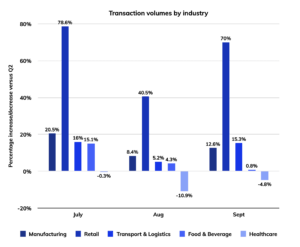

Oct 22, 2020 at 7:35 AMTradeshift Inc., provider of supply chain payments and marketplaces, today releases its Index of Global Trade Health for Q3 2020. This clearly shows slight recoveries in the markets despite the ongoing Corona crisis and its economic consequences.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.(San Francisco) – The number of orders and invoices exchanged through global supply chains increased by 15.2 percent in the third quarter, after having decreased by a similar margin in the second quarter. In July, there was a tremendous boost, which subsided again in August and September. Payments continue to be delayed, causing suppliers to struggle with liquidity shortages.

Transport and Logistics Sector Benefits from E-Commerce

One sector that has benefited from the shift to e-commerce is the transport and logistics sector. Many T&L companies were able to offset traditional B2B courier activities by transitioning to e-commerce. Trade activities across the sector remained relatively lively throughout the entire second quarter, and this continued into the third quarter.

General Data

Figures Industrial sectors – © Tradeshift Inc.

- The abrupt lockdown restrictions created a pressure cooker environment for supply chains. As the restrictions began to ease, orders increased significantly. This momentum continued into July and then subsided as supply lines normalized.

- The decline in orders in the second quarter also led to a financial “hangover effect” that persisted into the third quarter. Forty-five-day payment terms are now standard in supply chains worldwide, meaning that the decline in orders in the second quarter led to liquidity issues in the third quarter. The global order volume increased by 20.1% in Q3, while invoice payments to suppliers only rose by 14.1%.

Supply Chain Financing Supports Suppliers with Liquidity Shortages

Globally, orders increased by 20.3% in Q3, but the invoice volume could not keep pace with an increase of only 14.1%. The Eurozone is the only region that consistently exceeds the global average, primarily due to a significant increase in orders at the end of the second quarter, which is now reflected in supplier payments. The improvement in order volume in the third quarter is expected to provide suppliers with a welcome cash flow boost towards the end of the year. Whether all companies can hold out until then is another question. An average small business has about 27 days of cash available to survive without income. Many suppliers currently cannot afford to wait for invoice due dates. Therefore, innovative financing models that release liquidity faster are in higher demand than ever. “With our product Tradeshift Cash, we support companies and suppliers in this liquidity crisis. Suppliers can receive their money within two days based on selected criteria. With this model of supply chain financing, we enable companies to build a stronger supply chain by providing their suppliers with access to a constantly available cash flow — and strengthen the customer-supplier relationship,” explains Christian Laang, CEO of Tradeshift.

Further Information

Over 1.5 million buyers and suppliers in more than 160 countries use Tradeshift’s trade technology platform to exchange digitized purchasing and invoicing information. More than $500 billion in transactions are processed through the platform each year. The Tradeshift Index of Global Trade Health provides an analysis of business-to-business transaction volumes (orders processed by buyers and invoices processed by suppliers) across the Tradeshift network, compared month by month and quarterly with the previous quarter.Download the full report herehttps://tradeshift.com/de/Photos/Graphics: © Tradeshift Inc.