How Kühne Logistics University is Coping with the Corona Crisis

Apr 23, 2020 at 6:23 PMVTL Invests in Large-Scale Future Project VTL Next

Apr 27, 2020 at 4:22 PMThe Kühne + Nagel Group is feeling the impact of the coronavirus crisis in the first quarter of 2020, recording significant declines across all sectors. However, the group has a stable cash flow and solid liquidity.

(Schindellegi) As a result of the coronavirus pandemic, business volume in the first quarter of 2020 has decreased significantly. The net revenue, gross profit, and results of the Kühne + Nagel Group were well below the previous year’s level. Additionally, currency fluctuations had a markedly negative impact.

| Kühne + Nagel Group (Mio. CHF) | Q1 2020 | Q1 2019 | Change |

| Net Revenue | 4,912 | 5,237 | (6.2%) |

| Gross Profit | 1,878 | 1,978 | (5.1%) |

| Operating Result (EBITDA) | 378 | 418 | (9.6%) |

| EBIT | 184 | 242 | (24.0%) |

| Result of the Period | 139 | 181 | (23.2%) |

Dr. Detlef Trefzger, CEO of Kühne + Nagel International AG: “The coronavirus pandemic is an immense global challenge, also for Kühne + Nagel. Industrial production and trade volume have weakened significantly. In this situation, Kühne + Nagel was able to maintain its operational performance, closely manage a number of specialized businesses, and acquire new customers. The transport volume for raw materials and pharmaceuticals was maintained at a respectable level. Our company faces significant challenges in the coming months, but is well positioned given its customer proximity, agility, and digital offerings. High liquidity characterizes the solid financial strength of the company.”

| Facts and Figures about Kühne + Nagel during Covid-19: |

|

Sea Logistics

| CHF Mio. | Q1 2020 | Q1 2019 | Change |

| Net Revenue | 1,724 | 1,852 | (6.9%) |

| Gross Profit | 344 | 382 | (9.9%) |

| EBIT | 79 | 112 | (29.5%) |

With a significant double-digit decline in volume demand to and from China, the Sea Logistics segment was early affected by the impacts of the coronavirus crisis. On the other hand, reefer transports (including pharmaceuticals) and export volumes from Latin America (especially perishable goods) performed well. In the first quarter, 1.075 million standard containers (TEU) were transported, which is 71,000 units fewer than in the previous year (-6.2%).

The net revenue of the segment thus fell by 6.9% to CHF 1.7 billion, and the gross profit decreased by 9.9% to CHF 344 million. EBIT fell by 29.5% to CHF 79 million. Currency effects negatively impacted 5.3% (net revenue) and 3.6% (EBIT).

Even in the current environment, customer interest in CO2-neutral sea logistics solutions remained high. Under Kühne + Nagel’s Net Zero Carbon program, all CO2 emissions from less than container loads (LCL) have been offset since the beginning of the year.

Air Logistics

| CHF Mio. | Q1 2020 | Q1 2019 | Change |

| Net Revenue | 1,091 | 1,170 | (6.8%) |

| Gross Profit | 307 | 326 | (5.8%) |

| EBIT | 71 | 80 | (11.3%) |

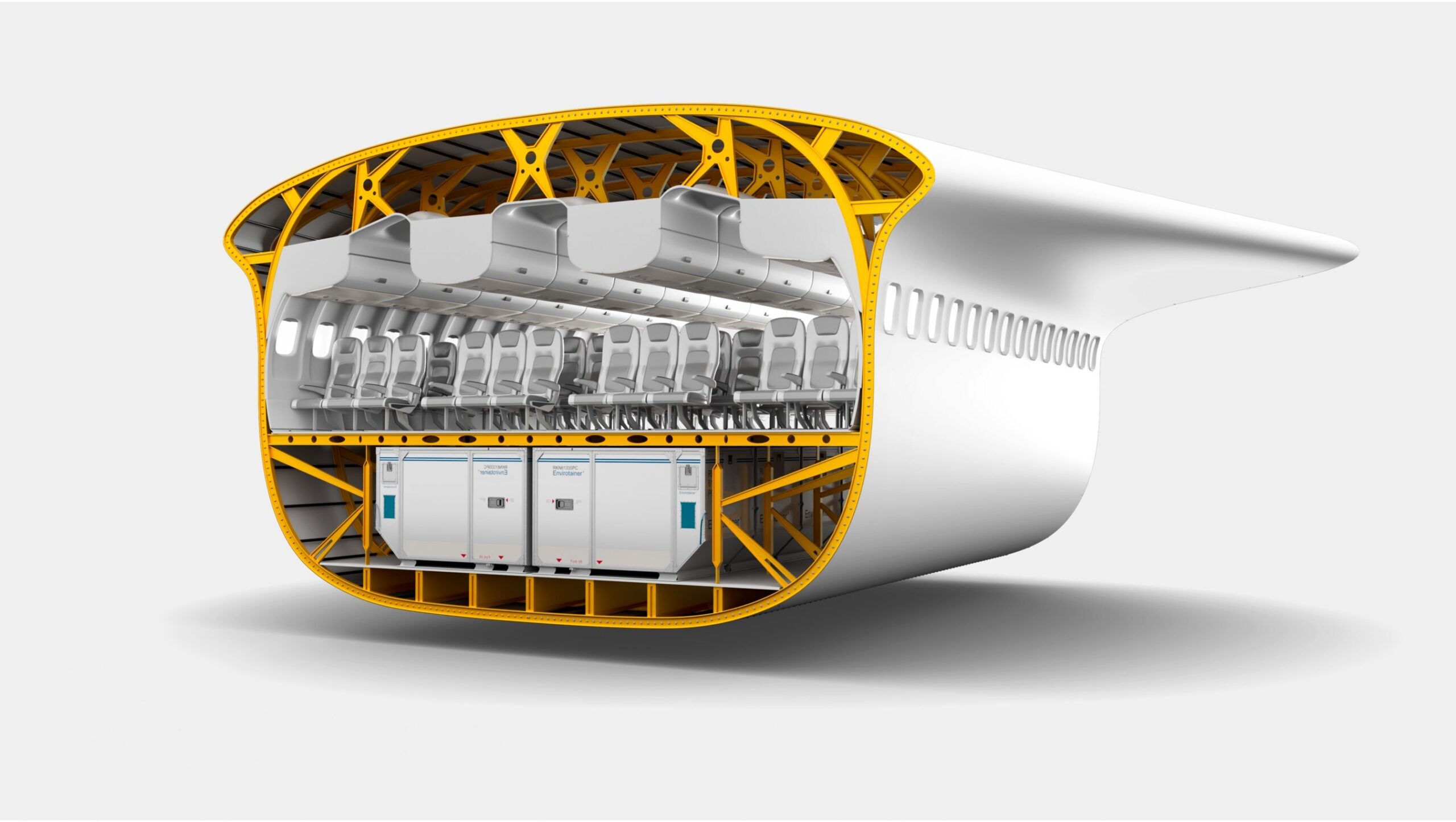

The Air Logistics segment was particularly affected by the coronavirus pandemic starting in March, when numerous passenger flights were canceled on the supply side. Global air freight capacity decreased by around 60% within a few weeks. On the demand side, lockdowns in China, Europe, and eventually America led to a sharp decline in consumption, resulting in lower air freight volumes. In contrast, short-term charter solutions for pharmaceuticals and time-sensitive transports became more sought after.

The air freight volume in the first quarter was 372,000 tons, which is 9% lower than in the previous year. The decline in net revenue was less pronounced at 6.8% to CHF 1.1 billion, and the decline in gross profit was 5.8% to CHF 307 million. EBIT fell by 11.3% to CHF 71 million. Currency effects negatively impacted both net revenue and EBIT by 5.0%.

Significant progress has been made in implementing the company’s own Transport Management Solution AirLOG and other digital platforms.

Road Logistics

| CHF Mio. | Q1 2020 | Q1 2019 | Change |

| Net Revenue | 863 | 901 | (4.2%) |

| Gross Profit | 281 | 285 | (1.4%) |

| EBIT | 17 | 24 | (29.2%) |

The Road Logistics segment started the new fiscal year solidly. However, from March onwards, the volume in Europe (particularly France, the UK, and Italy) and North America (mainly in intermodal business) declined significantly. All sectors were affected, except for e-commerce and pharmaceuticals.

In the first quarter of 2020, the net revenue of the segment decreased by 4.2% to CHF 863 million, and the gross profit fell by 1.4% to CHF 281 million. EBIT decreased to CHF 17 million. Currency effects negatively impacted net revenue by 4.8% and EBIT by 4.2%.

In Europe, the two acquisitions Rotra (Belgium and the Netherlands) and Joebstl (Austria and Eastern Europe) were integrated as planned. The development in Asia remained encouraging: Kühne + Nagel reports increased demand for its digital platform solution eTrucknow.

Contract Logistics

| CHF Mio. | Q1 2020 | Q1 2019 | Change |

| Net Revenue | 1,234 | 1,314 | (6.1%) |

| Gross Profit | 946 | 985 | (4.0%) |

| EBIT | 17 | 26 | (34.6%) |

In the Contract Logistics segment, the supply of automotive production and retail was particularly affected by the impacts of the coronavirus. However, demand for basic goods, pharmaceuticals, and e-commerce services increased.

In the first quarter of 2020, the net revenue of the segment decreased by 6.1% to CHF 1.2 billion compared to the previous year, gross profit fell by 4.0% to CHF 946 million, and EBIT decreased by 34.6% to CHF 17 million. Currency effects negatively impacted net revenue by 4.9% and EBIT by 3.8%.

The environment required a rapid and comprehensive adjustment of resources, with additional support from further progress in restructuring contract logistics. Throughout the quarter, 90% of all Kühne + Nagel distribution centers worldwide operated without interruption.

About Kühne + Nagel

With over 83,000 employees at nearly 1,400 locations in over 100 countries, the Kühne + Nagel Group is one of the world’s leading logistics companies. Its strong market position lies in sea, air, road, and contract logistics with a clear focus on integrated logistics solutions.

Photo: Kühne + Nagel

https://home.kuehne-nagel.com